Срочная публикация научной статьи

+7 995 770 98 40

+7 995 202 54 42

info@journalpro.ru

What drives remittances: case of Kyrgyz Republic?

Рубрика: Экономические науки

Журнал: «Евразийский Научный Журнал №10 2018» (октябрь, 2018)

Количество просмотров статьи: 2945

Показать PDF версию What drives remittances: case of Kyrgyz Republic?

Aigul Berigulova,

economist of the Chief economist group,

Eurasian Development Bank

The phenomenon of remittances has become an integral part of some economies in Central Asian region. Two crises of 2009 and 2014 have shown how drastically the economic situation in Kyrgyzstan, Tajikistan and Uzbekistan can worsen once they witness a dramatic fall of migrant remittances. The dynamics of remittances has become one of the main macroeconomic indicators that are closely tracked by policy makers at these countries. To predict possible shock spillovers via the remittances channel policymakers may benefit from the awareness of what macroeconomic variables remittances depend on. This paper makes an attempt to define main macroeconomic factors that may help policy makers to predict the future path of remittances.

Stylized facts: Kyrgyz Republic

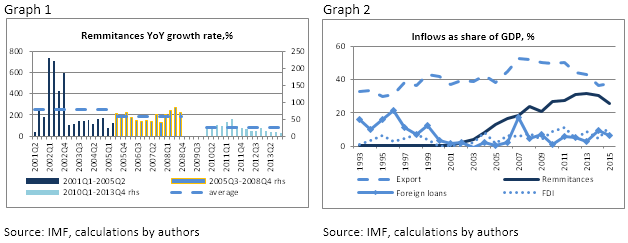

Remittances started to gain its importance in the mid of 2000s. For the period of

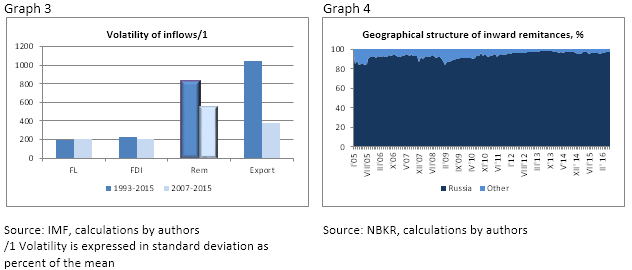

High standard deviation of remittances could be attributed to the fact that it has been growing at a more rapid pace than FDI and ODA inflows. While export’s standard deviation has declined in recent years, there still exists a potential for growth of remittances. This fact strengthens the importance of taking into account it future dynamics in the policy making process.

From the very origin there has being one main country donor of remittances for the Kyrgyz Republic that is Russia. Its average share for ten years constituted 94%, by this narrowing down the scope of possible factors that could determine volume of remittances coming to Kyrgyz Republic.

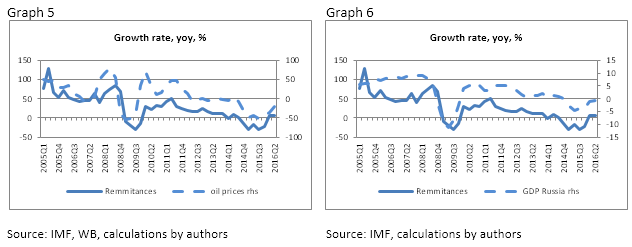

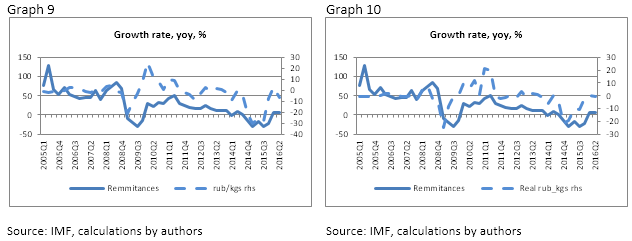

Downward swings in oil prices may serve as an early warning sign of gloomy prospective economic conditions of the Kyrgyz Republic, which is also true for the reverse case. On the graph 5 one can observe that growth rate of inward remittances replicates the pattern of the oil swings with the exception that remittances lag behind. Price surge during the period

The growth rate of Russian GDP influences the remittances in the same manner as oil prices with the exception that the indicator of Russian economic activity is more inertial and the magnitude of its impulse has changed over time. In 2009 the drop of Russian GDP amounted to 7% (average for 2008Q4-2009Q4), while remittances declined by 18% (average for 2009Q1-2009Q4). During the second crisis Russian GDP drop by 3% (average for 2014Q3-2016Q2) was accompanied by a deeper drop in remittances amounting to 23% (average for 2014Q4-2016Q2). This may indicate that exposure of Kyrgyz economy to Russian economy turbulence has increased over time.

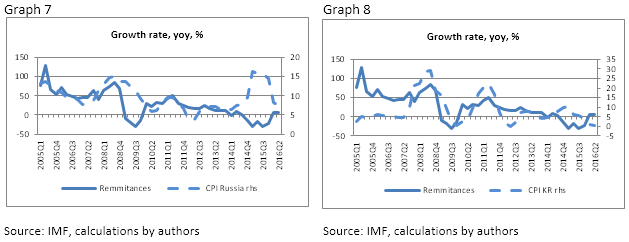

The inflation rate at the Russian Federation by itself does not clarify the situation. Once one brings in the inflation rate at the home country of migrant worker, it get’s obvious that the two countries’ inflation rate differential matters when an overseas worker decides on the amount to remit. Looking at graph 7 one can note that there are periods when inflation rate in Russia and growth rate of inward remittances co-move (2005Q1-2013Q4), and in some periods they diverge. While introducing difference of two countries inflation rates makes it evident that in periods when inflation in Russia exceeds Kyrgyz indicator, remittances inflow tend to decline.

Both crises have shown that appreciation of Kyrgyz som against Russian ruble is positively correlated with inward remittances (implying less inflow of remittances when exchange rate decreases). The same is true for the bilateral real exchange rate movements, for the exception of the fact that its dynamics is smoothed out or amplified by the inflation rate differentiation. During the first crises nominal appreciation of the som against Russian ruble comprised 7% (average of 2008Q4-2009Q4), in real terms 8%. Nominal appreciation amounted to 20% (average 2014Q3-2015Q4), while real appreciation was moderate and amounted to 11%.

Econometric Analysis: Kyrgyz Republic

We estimate a vector correction model for the Kyrgyz Republic to determine the response of remittances to shocks in macroeconomic variables. The choice of the approach rests on several grounds. First, most of macroeconomic variables are endogenous, brining into play multi-equation estimation. Second, many of the variables are non stationary, suggesting transformation to first or higher differences. And lastly, variables could be cointegrated.

The dataset covers the period 2000Q1-2016Q2 on a quarterly basis. We try to consider inward remittances as an export receipts, whereas instead of goods and services labor force is delivered abroad. For the simplification purposes we ignore related labor force indicators (unemployment rate, salary differentiation and so on) and concentrate on macroeconomic variables that may determine the volume of labor force exports, namely real GDP in Russia and exchange rate RUB/KGS and CPI in Russia and Kyrgyz Republic.

The data used in analysis are drawn from the IMF and WB databases, and the countries’ national agencies. Remittances (rem) data, in millions of US$ is taken from the IMF Balance of Payments Statistics, line item workers’ remittances. It is converted into ruble terms using quarterly average RUB/USD exchange rate and turned into real terms by deflating with Russian CPI (cpi_r, 2010=100), both are taken from International Financial Statistics (IFS) of the IMF database. Real Russian GDP (y_r), in billions of rubles and at 2008 prices, is taken from Russian Federal State Statistics Service. Kyrgyz CPI index (cpi_k) with the base year 2010 is drawn from the IMF IFS database. Monthly exchange KGS/RUB rate (rub_kgs) is taken from the National bank of the Kyrgyz Republic and converted to quarterly by averaging. Data are seasonally adjusted and turned into logarithmic terms.

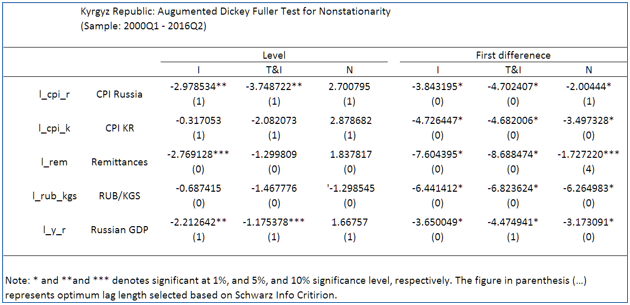

We first test for the presence of unit roots in macroeconomic time series using the Dickey Fuller test and find that all series are integrated of order one. The optimum lag length was selected based on Schwarz Info Criterion. All three types of model were checked with constant (I), constant and time trend (T&I), and without any of it (N). As shown in Table 1, the data series are found to be non stationary in levels in the model that includes neither intercept no trend. Once we take the first difference of all variables, they start to comply with stationarity conditions of all three models. Hence, all series are integrated of order one.

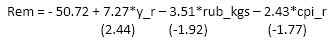

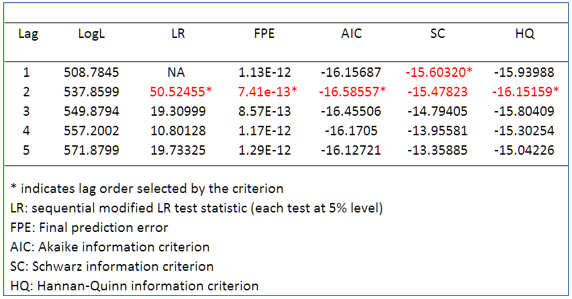

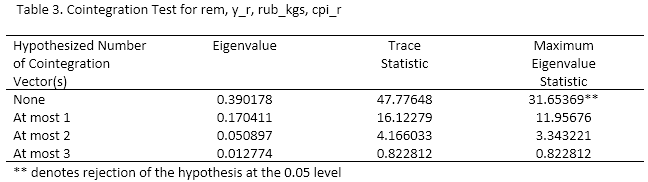

Next, we test for the existence of cointegration vector and find one cointegration relationship. The lag order was defined basing on the fact that five out of six VAR Lag Order Selection Criteria suggested to choose 2 lags. Hence, for cointgration checking procedure number of lags was defined as p-1 that is 1 lag. Eigenvalue statistics confirm the existence of cointegration relationship between remittances, real GDP, the exchange rate, and the price level. Trace statistics indicates no cointegration at the 5% significance level, while one is found at 10% level. No cointegration relationship was found between remittances and price level at the Kyrgyz Republic. Over the long run, remittances move with other macroeconomic variables based on the following cointegration relationship (t-statistics in parenthesis):

Over the long run, increase as Russian economy expands, decline as the Russian ruble weakens against Kyrgyz som (rub_kgs increases), and decline as price level in Russia increases.

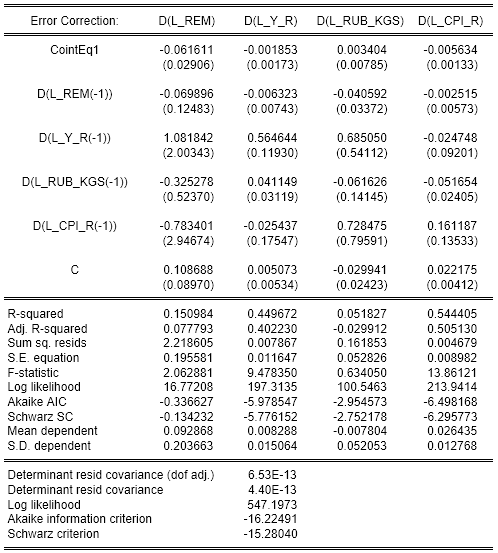

The estimation of the VEC model confirm the evidence presented earlier, namely that remittances respond to shocks in GDP, the exchange rate, price level. The estimates of VEC are presented in Table 4.

Conclusions and policy implication

Stylized and empirical analyzes indicate that inward remittances of the Kyrgyz Republic heavily depend on external factors such as oil prices and the economic situation at the Russian Federation.

Oil prices dynamics may serve as an early warning indicator for Kyrgyz policy makers. It is remarkable that the response magnitude of the remittance to the oil price shock has not changed much over time. Stylized facts show that during both crises of 2008 and 2014 a 40% decline in oil prices was accompanied by 20% decrease of inward remittances.

Kyrgyz remittances are procyclical with Russian economy: remittances increase when economic activity in the donor country accelerates and they decrease when economic satiation worsens. However unlike the oil prices the degree of influence of Russian GDP has increased over time.

Remittances fall when exchange rate of Russian rubble weakens against Kyrgyz som, as well as when the price level in Russia exceeds the price level in Kyrgyz Republic.

References

Список литературы

- IMF database. URL https://www.imf.org/en/data.

- Lueth E., Ruiz-Arranz M., 2007. Macroeconomic Determinants of Workers’ Remittances. Paper presented at the Conference: POLICY OPTIONS AND CHALLENGES FOR DEVELOPING ASIA—PERSPECTIVES FROM organized by the IMF and Japan Bank for International Cooperation.

- National bank of the Kyrgyz Republic. http://nbkr.kg/index1.jsp?item=1785&lang=RUS

- World Bank database. URL https://data.worldbank.org/

- World Bank database. Commodity markets. URL http://www.worldbank.org/en/research/commodity-markets

- Бердигулова А., Имаралиева Н. Какие макроэкономические факторы определяют объем денежных переводов трудовых мигрантов: пример Кыргызской Республики // Евразийский научный журнал. 2017. № 2. С.

259–265.

Appendix

Table 1

Table 2. VAR Order Selection Criteria for rem, y_r, rub_kgs, cpi_r

Table 3. Cointegration Test for rem, y_r, rub_kgs, cpi_r

Table 4. Vector Error Correction Estimates/1

/1 Sample: 2000Q3 2016Q2; 64 observations; standard errors in parenthesis